SME to Equity Portfolio Management

Focus on Rekindle Productivity through redeeming of SMEs in the Operation of the POPUP Eco-System

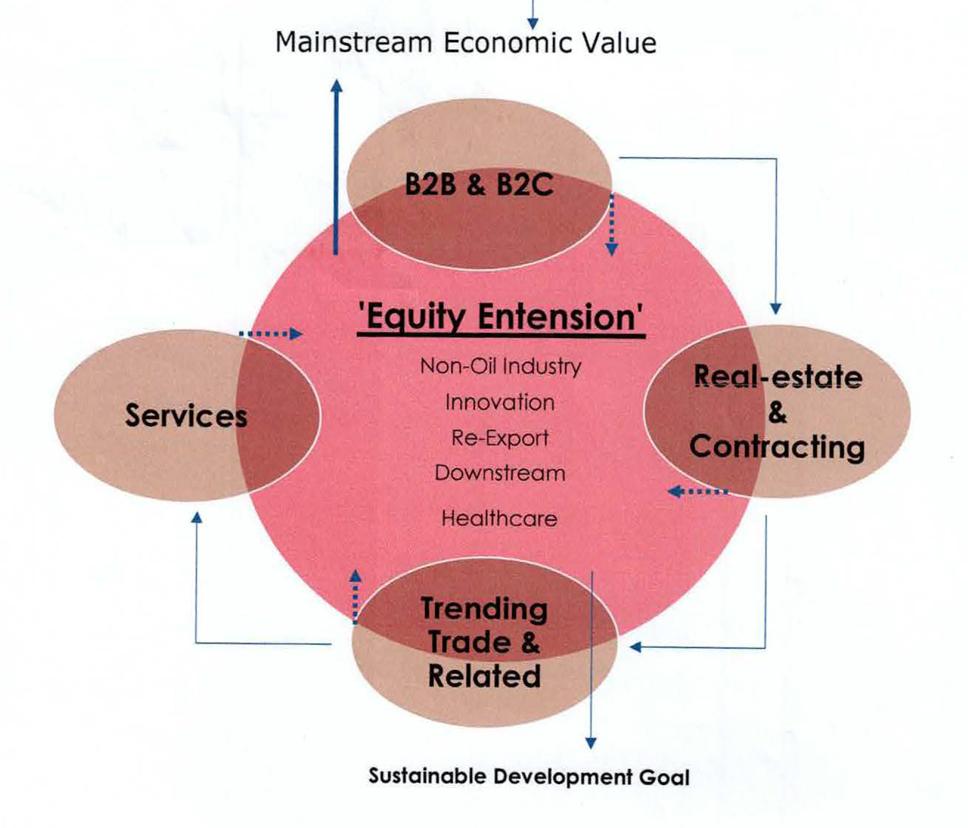

What is the New Methodology for Practicing the Equity fund model for creating national interest-driven SMEs?

Executive Summary (Business Turnaround in Equity Fund)

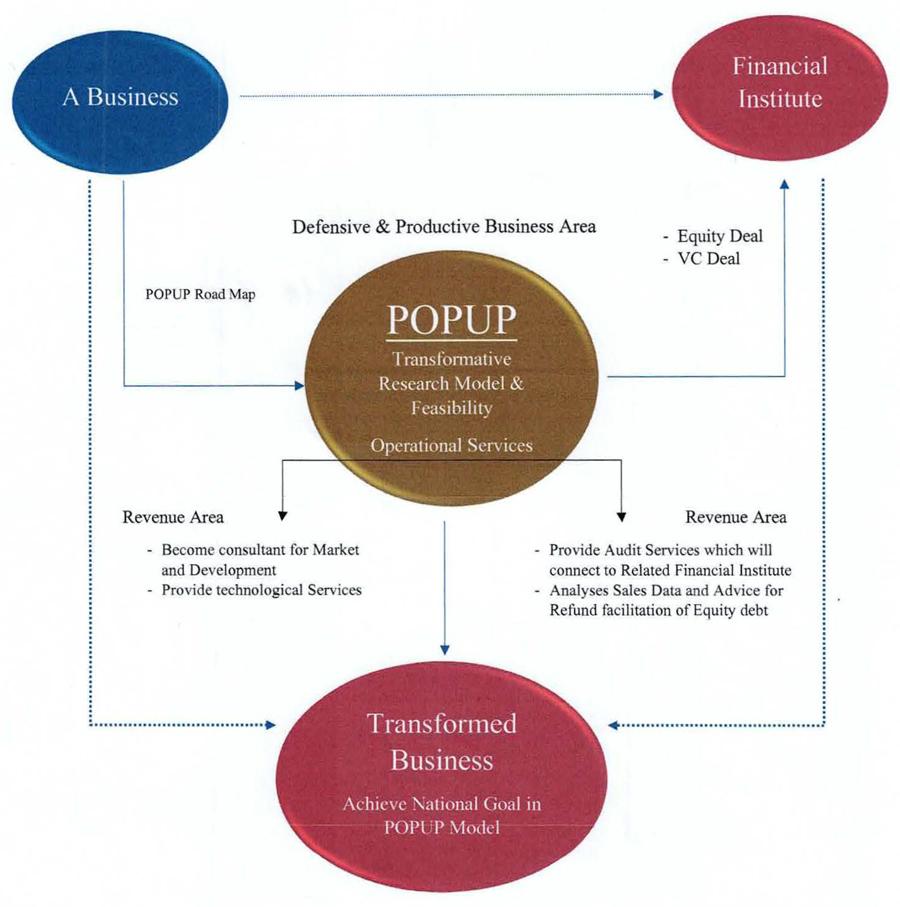

In order to practice the Equity Fund model on current economic power which belongs to various SMEs, in centralizing Equity firms with the collateral role of POPUP for national economies, generate a general model that can impact SME-driven national interest-based economic development where the internal assets of significant enterprises will be converted for new equity value with related transparency in reflection of the Cost Control Mechanism (CCM). This model will provide a backup of the solution to the Ql\TV2030 environment in creating key demand.

Consolidated Advantages and Revenue Area

Considering growing equity fund programs across regions that promote equity deals in order to increase the defensive business environment and transparency from the banking system, POPUP can be equipped with a substantial and effective number of equity deals in their own operational services. It will also increase the high feasibility of services for defensive equity solutions and capital inflow through POPUP based on the base of Central Position.

Customization of SMEs under the POPUP umbrella

A substantial number of SMEs in Trade possession and equity fund-driven financial markets would be Centralized under the single network of POPUP.

- Where human capital engagement is regulated as per country law

- Where needful equipment will be attached with new progress.

Streamline and Efficiency on Employee and Institution

- Where related businesses in which been newly converted to be consume less timeline of operational teaming

Key Message

In the GCC, the answer for Why SMEs are struggling in Qatar is verily different compared to the rest of the regional members despite the GCC internal market having proportionate economic rights.

GCC members, strategically provide opportunities which being induce high-networth individuals via global interest-based economic value. but, Qatar provides strategic support and welcomes national interest-based entrepreneurship which can drive sovereign economic value.

Across the SMEs in Qatar challenging long-term growth prospects and growth slowdown have not fully presented ground suggestions which should be done by strategic resources in the country.

Nearly all the SME forces that powered the growth of the FIFA environment have suffered in individual inflation since the demand has declined and most of the enterprises that were conceived amid a significant development period are lifted from the categories of national interest-based enterprises.

In particular, identified largely-stricken-SME-environment are substantial threats to potential investment-inflow and emerging markets that attract national interest. as well, as of now, addressing necessary all-level challenges to be going in the potential direction is the general goal of SMEs.

But in real, more companies are striking deals and seeking to raise capital through debt or equity offerings, and sharing expectations of a long-term presence in the deal-making process. In fortunate, conducted research has found a couple of weaknesses, one of which is Qatar's banking industry mostly interested in both innovative industrial solutions and national economic development rather than funding suffering enterprises in order to get rapid and long-term profit motive, as well as rest of which is expected level comprehensive knowledge of SME owners are not like-minded to national interest since they personally have set a goal for high net worth individual.

But these challenges and slowdown of SMEs can be reversed by the key development objective in the extensive practice of both VC equity and Equity portfolio.

As identify general challenges which impact SMEs downturn, majorly influences as below.

1. Consolidated Reform of Regional Economic Development in significant sectors

2. Growth of Foreign economic presence along with a nationalization program

3. Internal competitiveness in the GCC internal market

What is the solution for struggling SMEs? (customizing them in the new venture)

What is the business turnaround for Struggling SMEs amid these weaknesses found?

in the abstract, this paragraph discusses national interest and its current steps as per National Development strategy-3 (NDS3 2024-2030), which clearly shares where there will be no support for SMEs who are ready to continue FIFA-based similar

operation apart of national interest.

NDS3 mainly calls the following development. - innovative sector, expansion of downstream industrialization, non-oil local economies, and re-export motivation including sustainable development goal, but are the environment to empower

struggling SMEs apart of individual missions.

Equity portfolio demand in Qatar among SMEs links with Banking Culture.

Both VC and equity-based financial cultures have rarely reached entrepreneurship in Qatar including the Gulf zonal since banking culture substantially dominated the economic environment in easy access driven-lending programs of individual development economic opportunities.

NDS I, NDS2, and NDS3 of Qatar have not created risky challenges to entrepreneurship because most parts of the locally owned space which particularly bases ESGs are still waiting for national accomplishment.

Securing loans and attracting investors remains a hurdle. SMEs lack the collateral and extensive credit history of VC and Equity deals, leading to higher borrowing costs and a perception of risk that makes bankers hesitant. But overall bad experience in the lending market of the banking industry currently delivers strategic foray and biased monitory to national economies. in order to pursue existing operational investment even in diversification or extension, situational demand of SMEs at this overall challengeable period, eying on a financial solution that completely suites Equity and VC's strategy.

When the both VC and Equity Portfolio culture does not substantially penetrate SMEs in any country (Qatar), the collaborative move can be practiced in VC deals or Equity Portfolio as a backup solution to reach the exact goal of Investment Equity.

Practicing SME to Equity Fund-Method from Banking Culture

Qatar's economies and dependencies were to be strengthened

l. Local (and Regional) Sovereign Value

2. Mainstream Economic Value